do travel nurses pay state taxes

Typically Travel Nurses receive a lower base pay than permanent Pros with the difference made up by non-taxable reimbursements. Be subject to Ca.

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Those are required by the Federal Insurance Contributions Act FICA and fund.

. 250 per week for meals and incidentals non-taxable. For general questions and answers on salary and open positions complete the form for a quick question call 800-884-8788 or apply online today. The date to file your taxes by this year is Monday April 18 2022.

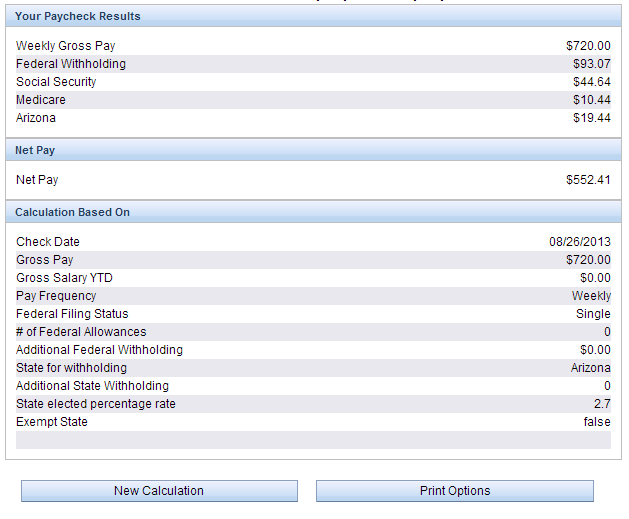

For W2 employees FICA tax of 153 of gross earnings is deducted from their paycheck to fund social security and medicare and their employer pays for half of the tax. 22 for taxable income between 40126 and 85525. 24 for taxable income between 85526 and 163300.

State travel tax for Travel Nurses. Im only going to address the issue of tax-free stipends aka per diems the IRS kind not the nurse shift kind for nurses who maintain and pay for another residence while temporarily on travel assignment. Tax deductions for travel nurses also include all expenses that are required for your job.

Resources on tax rules for travelers and some key points. 500 for travel reimbursement non-taxable. 2000 a month for lodging non-taxable.

This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you can think of these as travel expenses. Reimbursements are business-related expenses that you have paid for out-of-pocket that your employer pays you back for. I live in Florida and receive a retirement pension form the military.

Thats the tax rate on one more dollar of. But state law company policies and the terms of your travel nursing assignment contract may provide additional overtime pay and an increased holiday pay rate. You will owe both state where applicable and federal taxes like everyone else.

My question is would ONLY the income earned in Ca. Maintain a mileage Log and keep. Travel nurses on the other hand receive a base rate and a reimbursement or an allowance for housing food and other travel expenses.

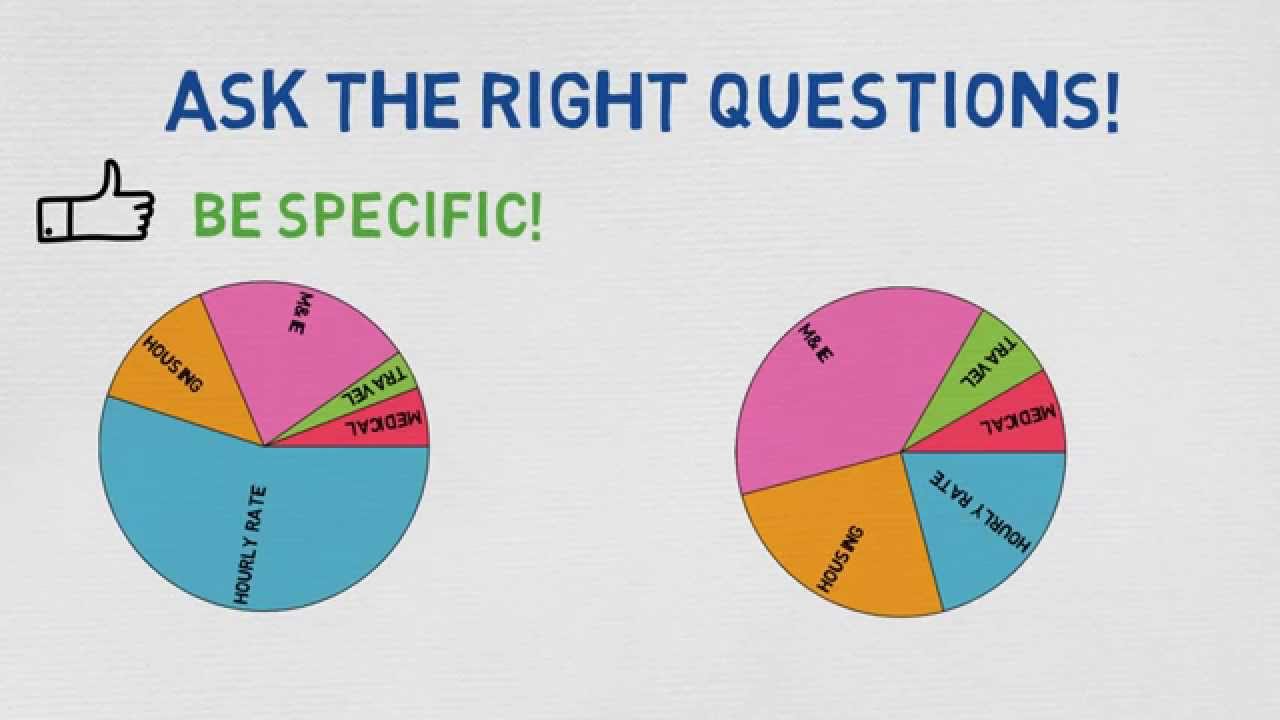

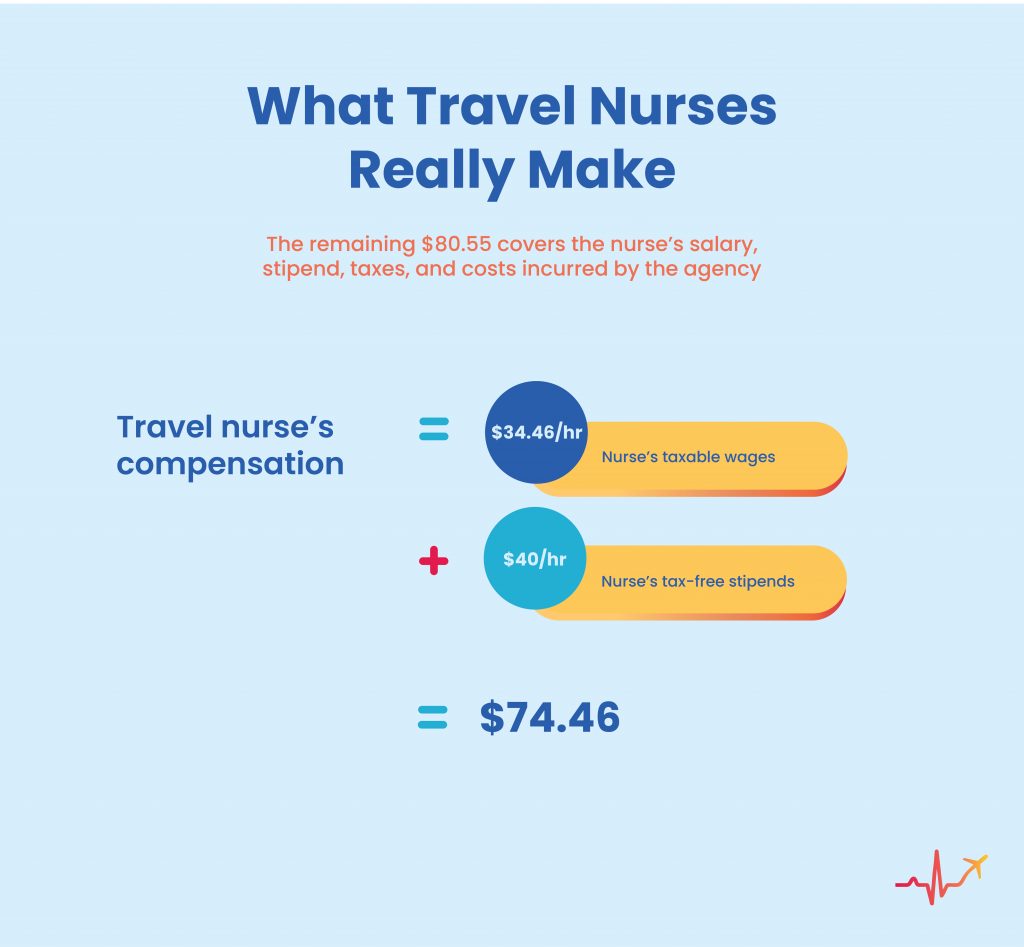

20 per hour taxable base rate that is reported to the IRS. Your blended rate is calculated by breaking down your non-taxable stipends into an hourly. Some agencies will outright refuse to do this as it requires additional work to add a second state.

Nursing boards and state tax agencies readily exchange information and some states treat tax delinquency as a basis for non-renewal of a license. For most travel nurses hourly wages will be reported on a W-2 form and subject to 1530 in payroll taxes. When doing proactive planning Willmann says its important to pay attention to your marginal tax rate.

Hi there I am considering travel nursing to California but I do not know how the state income tax works there. Travel nurse earnings can have a tax advantage. Either way the faster you file the quicker you cash in on whatever refund you may have coming.

For nurses domiciled in a compact state the filing of a resident tax return is universally expected for renewal or validity. The base rate is taxable but the reimbursements or allowances may be tax-exempt if youre working away from your tax home. There is no possibility of negotiating a higher bill rate based on a particular travel nurses salary history or work experience.

1 Ask your agency to withholding for your work state AND additional amounts for your home state. The costs of your uniforms including dry cleaning and laundry costs. These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses.

Any phone Internet and computer-related expensesincluding warranties as well as apps and other. Take a moment to read five travel nurse tax tips. There are at least 4 ways to fill this gap.

If after these Travel Nurse Tax Tips you still have any questions can help please check the IRS guide on travel expenses here. Travel Nurse Tax Tip 2. If they can this is the fastest way.

Travel Nurse Tax Tip 1. A 1099 travel nurse handles all their documentation and taxes themselves. Keep hard copies of all contracts and paperwork.

Traditional full-time nurses receive a taxable salary from a single employer. State income taxes or would my retirement pe. Here is an example of a typical pay package.

Because Travel Nursing makes filing taxes more complex however the IRS is usually lenient. You can file taxes yourself using IRS e-file or hire a tax professional to file for you. 12 for taxable income between 9876 and 40125.

Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax. Others can read this sites handy advice. There are a handful of important tax advantages to be aware of as a travel nurse primarily in the form of stipends and reimbursements.

Its not enough to simply abandon a residence but establish a new one. 10 for the first 9875 in taxable income. This is typically done in the form of an expense report.

This means theyll have to calculate and remit all taxes to the IRS and state authorities. Make sure you have paperwork proving your start and end dates to prove temporary work. Tax break 3 Professional expenses.

For more on how state income tax impacts travel nurse salary seek the advice of a tax professional who is familiar with filing state income taxes for travel healthcare professionals. These will make filing taxes at the end of. If your home state has a higher tax rate you have a gap to fill.

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

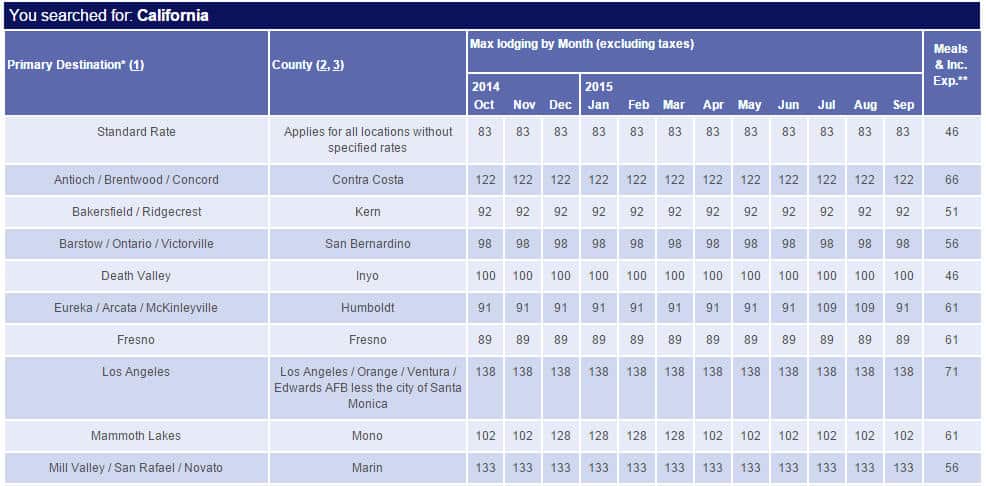

6 Things Travel Nurses Should Know About Gsa Rates

Trusted Event Travel Nurse Taxes 101 Youtube

Travel Nurse Tax Deductions What You Need To Know For 2018

Travel Nurses Are In High Demand Are You Eligible To Travel Travel Nursing Travel Nursing Companies Nurse

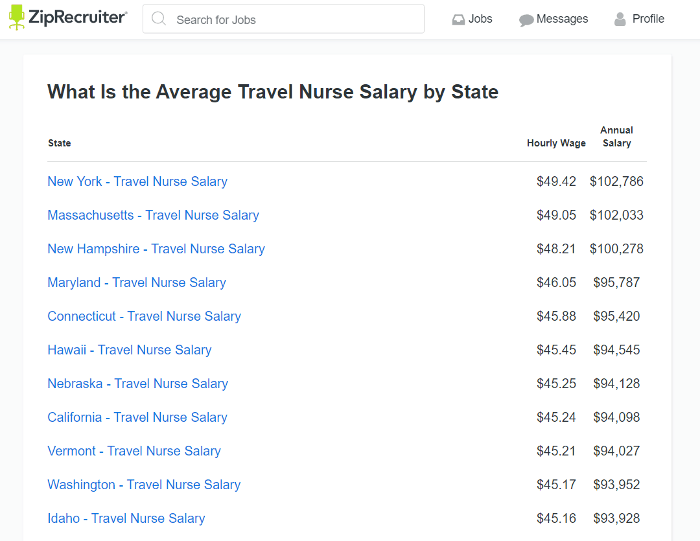

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

All You Need To Know About Travel Nursing In The Us Infographic Travel Nursing Nursing Infographic Nursing Programs

State Tax Questions American Traveler

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog

Understanding Pay Packages For Traveling Nurses 2021 Marvel Medical Staffing

Travel Nurse Insight What Goes In To Pay Packages

How To Make The Most Money As A Travel Nurse

How Much Do Travel Nurses Make Factors That Stack On The Cash

How To Calculate Travel Nursing Net Pay Bluepipes Blog

6 Things Travel Nurses Should Know About Gsa Rates

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog